DeFi is poised to transform the lives of billions. With just an internet connection, people can access essential financial services and economic opportunities—without gatekeepers or middlemen. Two of the most powerful DeFi use cases are yield and credit, empowering people to grow their assets, borrow against them, and make their wealth work harder.

The future is tokenized. From homes and land to stocks and collectibles, real-world assets are moving onchain. Ripe enables users to earn yield on previously dormant assets and borrow against those that couldn’t serve as collateral before. And because Ripe is governed and owned by its users, they collectively share in the protocol’s economic benefits.

The Ripe protocol is best understood by exploring its key components:

💰 Deposits & Loans — the basics of Ripe

🏦 The Endaoment — the yield generation machine

🌱 Bonding Mechanism — the fundraising machine

💵 GREEN token — the protocol stablecoin

💧 Stability Pool — where risky debt is absorbed

🏛️ RIPE token — onchain, fully decentralized governance

🧃 Juice Score — incentives for being a good citizen

Deposits & Loans

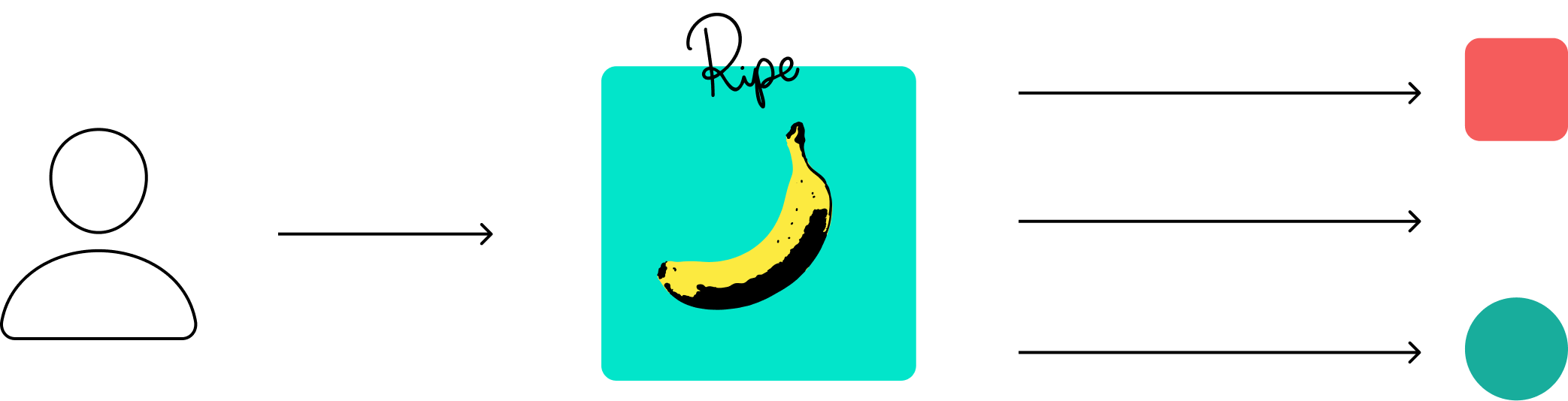

Users can deposit a range of assets into the Ripe protocol, such as stablecoins, governance tokens, yield-bearing positions, DEX LP positions, NFTs, or tokenized real-world assets (RWAs) – all subject to governance approval. Additionally, users can borrow against their deposited assets.

Leveraging External DeFi Strategies for Native Yield

Ripe protocol's extensible deposit framework allows users to access yield opportunities from other DeFi protocols. Once governance approves an integration, it becomes a deposit strategy on Ripe. For example, a USDC depositor can choose strategies like Aave, Compound, Yearn, Morpho, or Fluid, earning the same yield as if they deposited directly into the protocol.

Boosted Yield Through Ripe's Endaoment

Depositing into strategies via Ripe offers two key advantages beyond the native yield:

Endaoment Yield: As the Endaoment generates yield, a portion is shared with Ripe depositors (governance decides via a gauge-weight voting system).

RIPE Rewards: During the bootstrapping phase, governance can decide to distribute RIPE tokens to depositors as an additional reward.

Even assets without native yield, like wBTC or NFTs, can earn real, sustainable yield through the Endaoment. This is how users can "earn yield on anything."

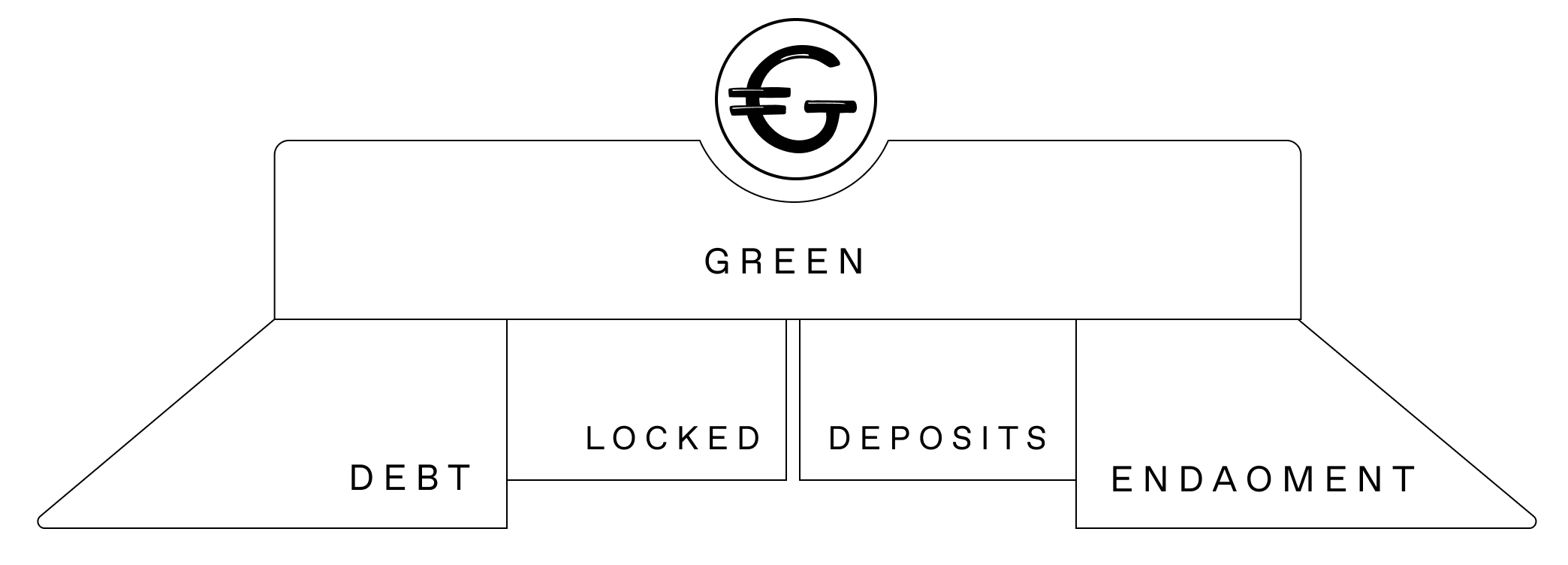

Locked Deposits as Soft Backing for GREEN

Users can lock deposits, with or without a loan, to earn a larger share of Endaoment Yield and RIPE Rewards. Early withdrawals are allowed with a small exit fee.

Locked assets serve as “soft backing” for GREEN, supporting the system without being seizable unless tied to an outstanding loan (in which case they become “hard backing”). Governance uses this data to adjust bonding parameters like capacity and discounts.

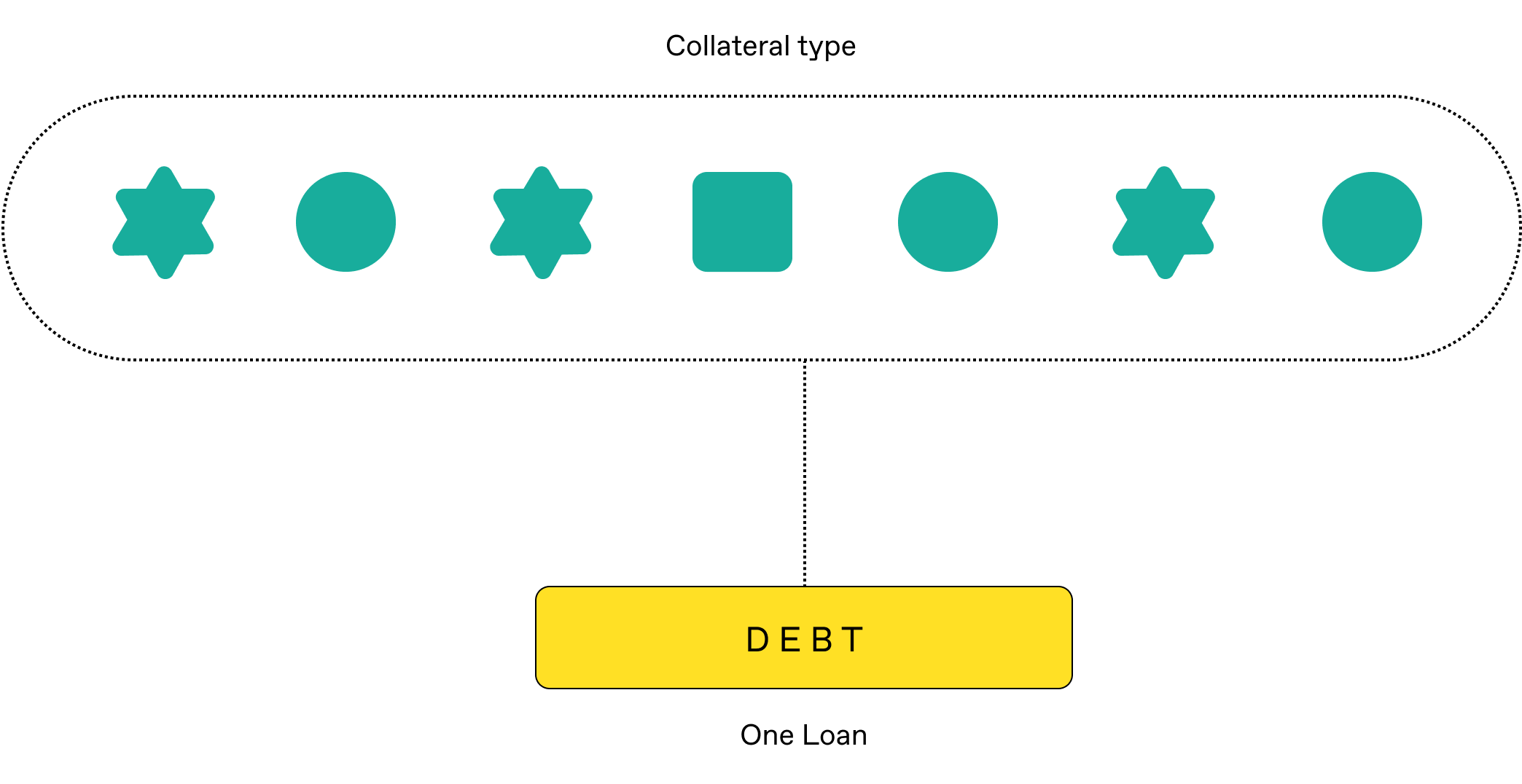

Unified Borrowing & Collateral Aggregation

Ripe allows users to borrow against deposited assets, with risk parameters set by governance for each strategy and asset. For example, users might be able to borrow up to 80% of stablecoin value, like USDT, but only 50% for NFTs like CryptoPunks or tokenized equities.

Deposits are aggregated to determine borrowing capacity, enabling users to secure a single loan backed by multiple assets. This simplifies debt management and reduces risk by diversifying collateral. Unlike most DeFi lending protocols, Ripe offers instant borrowing without requiring a counterparty.

Loan Issuance

Loans are issued in GREEN, a synthetic stablecoin pegged to the US Dollar and fully backed by collateral, similar to MakerDAO’s DAI. Users can deposit GREEN into the Stability Pool to earn yield, use it in other DeFi protocols, or swap it for other assets.

Interest rates are dynamic, based on factors such as asset risk, debt utilization, GREEN’s peg stability, and the borrower’s Juice Score. If collateral value nears the loan amount, liquidation may occur. Interest accrues in GREEN and can be repaid anytime, with all interest going to the Endaoment.

Unique to Ripe, even collateralized assets continue to be productive and earn yield, allowing users to maximize the utility of their holdings while managing debt.

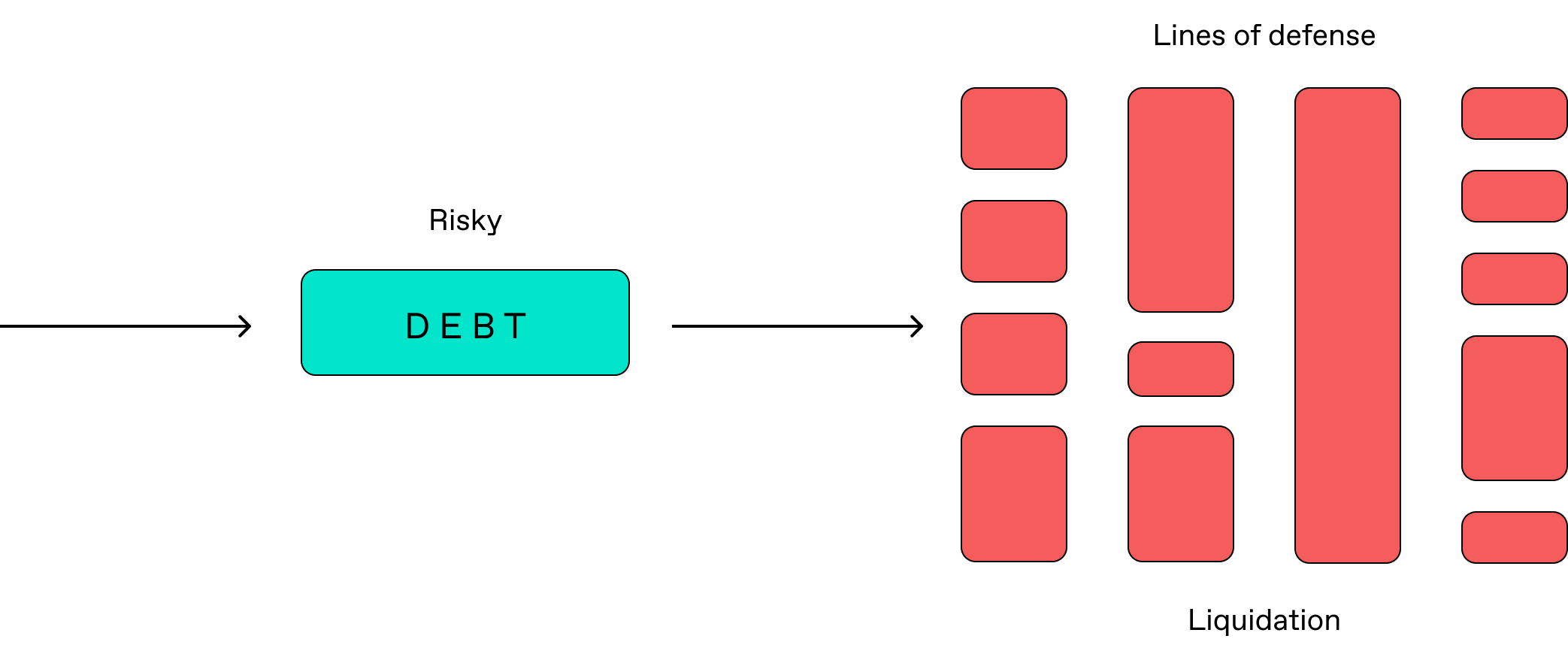

Liquidation Process & Risk Mitigation

If a user's collateral value drops too close to their debt amount, they risk liquidation. The protocol only claims enough assets to restore a healthy collateralization ratio, usually resulting in only partial liquidation. Liquidations are vital for ensuring GREEN stays backed and stable.

To ensure efficient liquidations, Ripe employs several methods, each as a fallback if the prior one is insufficient:

Stability Pool: Instantly buys liquidated collateral at a discount.

Endaoment: Claims stablecoins from the liquidated user.

Token Auctions: Users can buy liquidated fungible assets at increasing discounts over time.

NFT/RWA Auctions: Liquidated NFTs/RWAs are auctioned, with the highest bid winning at auction close.

Regulated or permissioned assets such as RWAs bypass the Stability Pool and Endaoment. Only allowlisted users can participate in auctions for these assets.

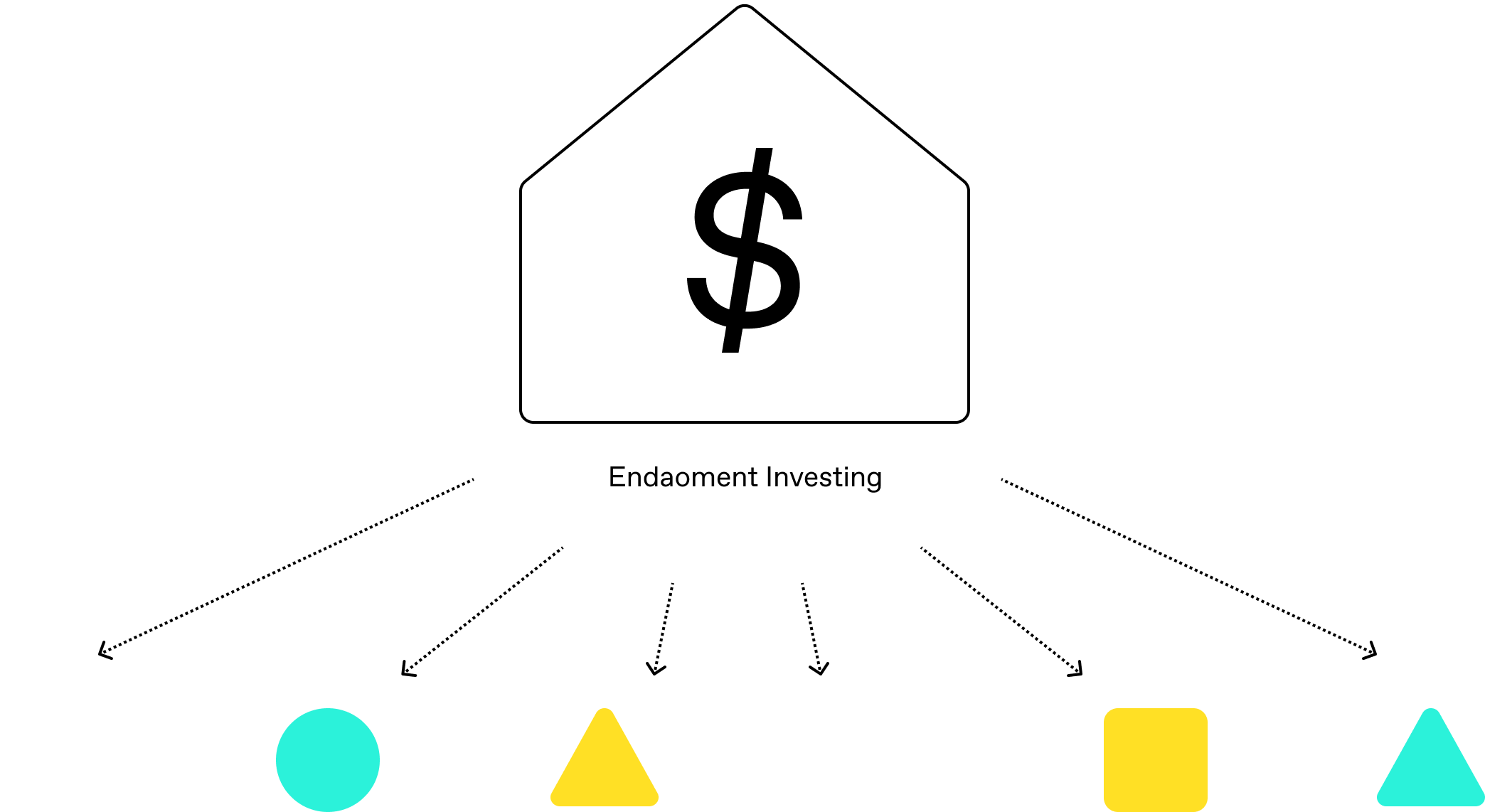

The Endaoment

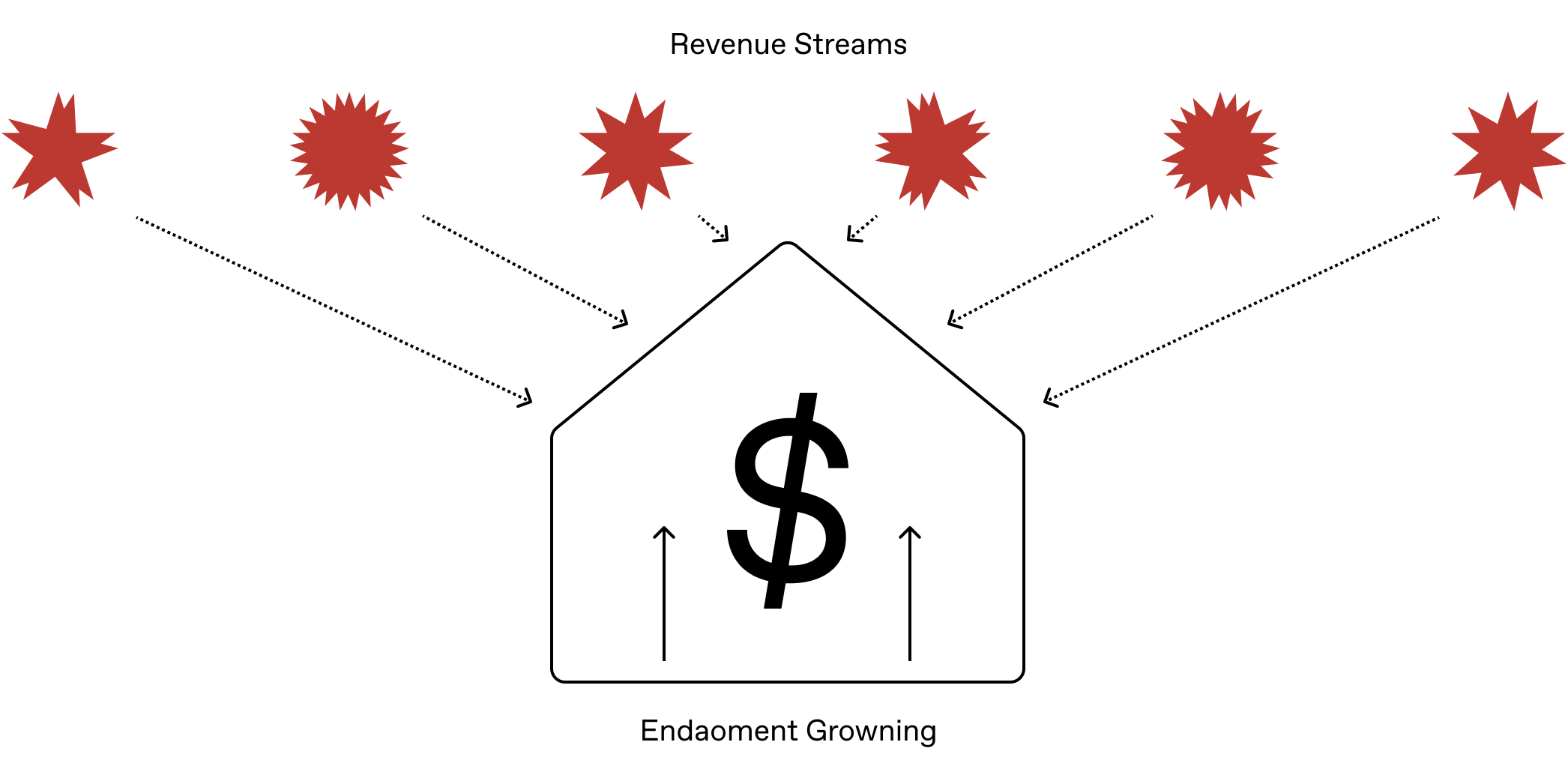

Ripe’s Endaoment aims to create a sustainable rewards system, where the principal remains invested and only the gains are distributed, similar to traditional endowments.

The protocol shouldn't rely solely on RIPE token emissions for incentives. While DAO governance may occasionally use emissions to bootstrap liquidity or distribute governance tokens, this is not a sustainable, long-term solution.

Revenue Streams Powering the Endaoment

All Ripe protocol revenue flows directly to the Endaoment, which grows alongside the protocol. Revenue is generated through:

Borrow Interest: collected when loans are repaid; unpaid interest is a receivable asset.

Daowry (origination fees): charged when borrowers initiate loans.

Liquidation Fees: applied to borrowers whose assets are liquidated.

Redemption Fees: incurred when users redeem GREEN tokens for Endaoment positions.

Deposit Lock Exit Fees: paid when users withdraw locked deposits early.

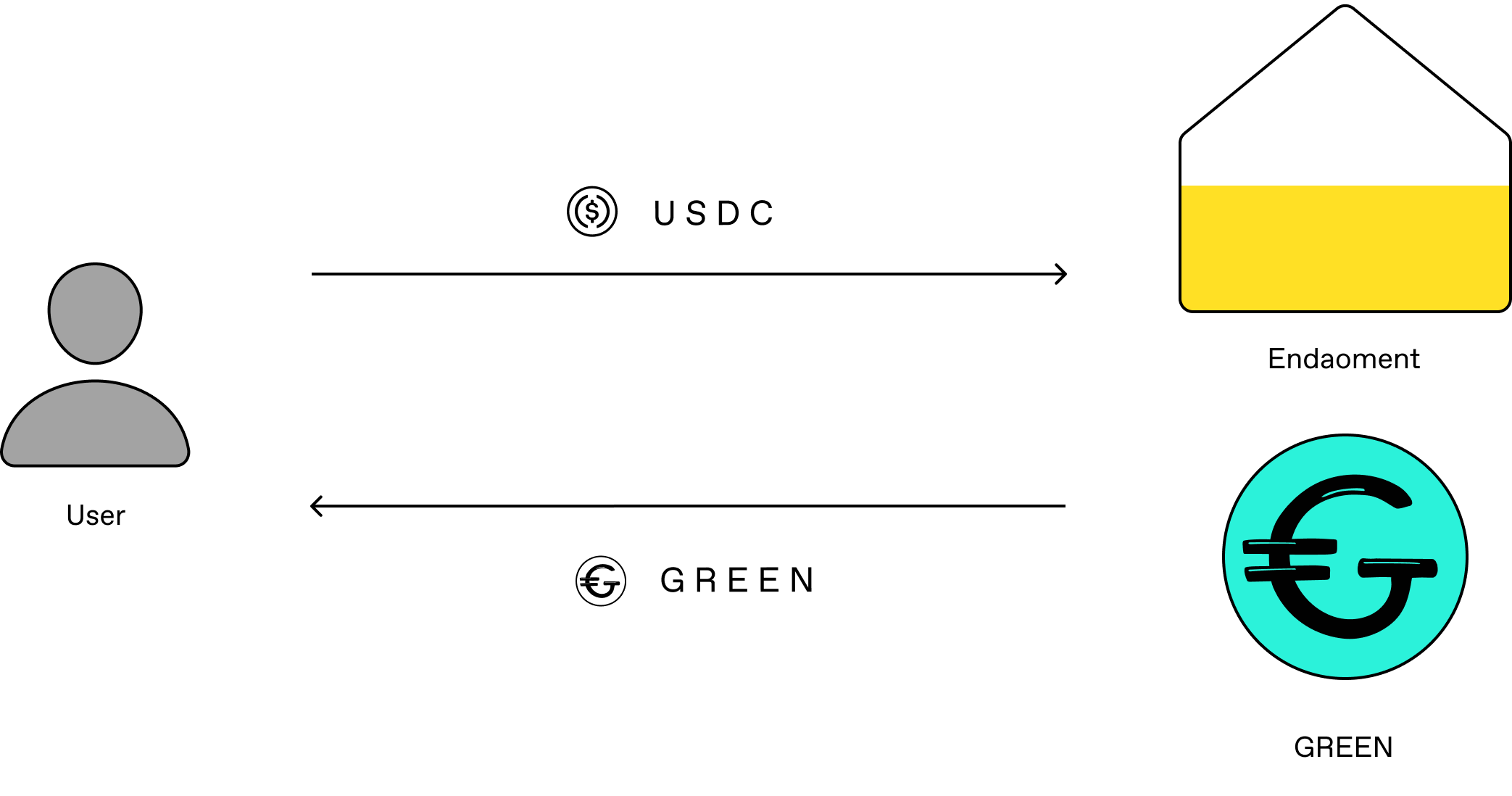

Bonds as a Tool for Endaoment Growth

Protocol revenue will take time to ramp up. To bootstrap the Endaoment, the protocol can sell RIPE or GREEN tokens at a discount—we call this bonding—with all proceeds going to the Endaoment. Ripe’s bonding mechanism plays a crucial role in raising funds to grow and sustain the Endaoment.

Since GREEN enters circulation through bonding, the Endaoment primarily invests in safe, blue-chip stablecoin strategies to ensure secure backing for GREEN.

Governance-driven Investment Allocations

RIPE token holders control how Endaoment assets are invested, adjusting their preferred allocation across strategies and assets. This occurs through Dynamic Voting, Ripe’s fluid governance system. The Endaoment programmatically follows these weighted preferences, ensuring token holders have direct control over Ripe’s treasury.

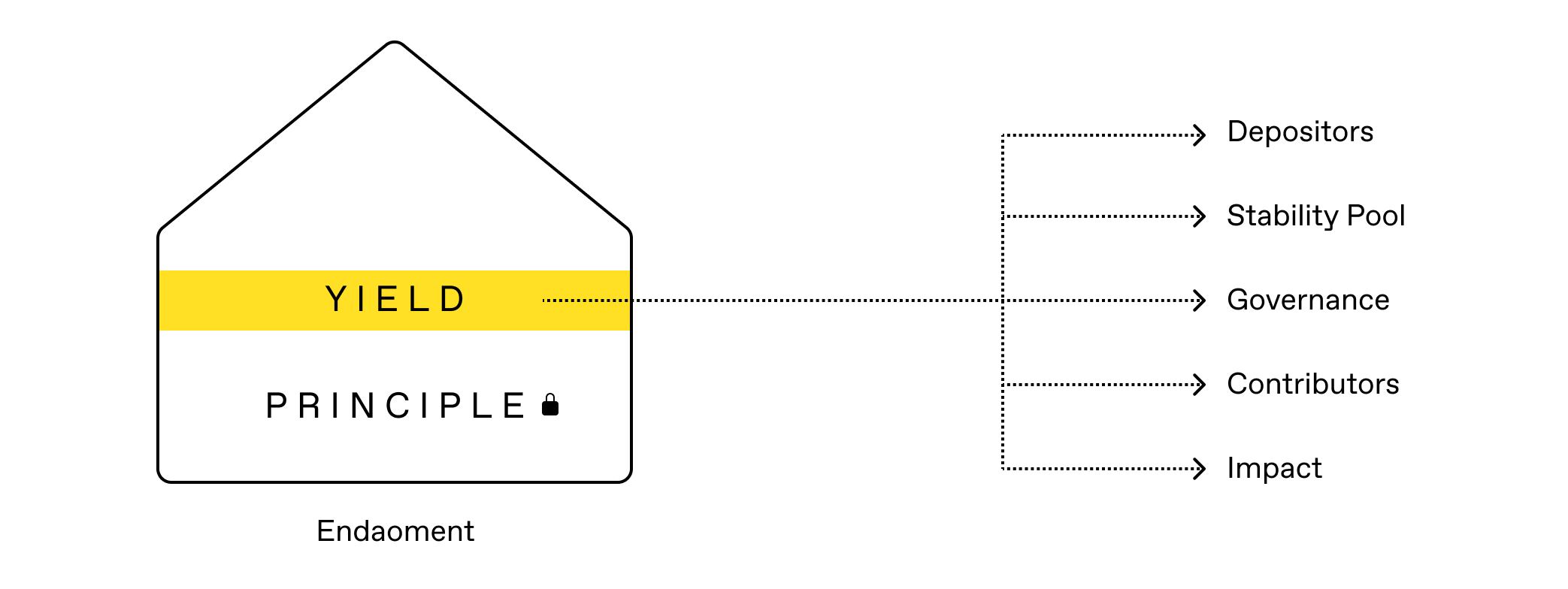

Governance-driven Yield Distribution

RIPE token holders determine how Endaoment yield is distributed (also through Dynamic Voting). They can allocate yield to:

Depositors: allowing users to 'earn yield on anything.'

Stability Pool: for users who deposit GREEN or GREEN LP.

Governance: for users who deposit RIPE or RIPE LP.

Contributors: DAO members in supervisory roles.

Impact: charitable donations.

When Endaoment yield is realized, GREEN tokens are minted and distributed, while the underlying assets remain in the Endaoment to generate more yield, backing the new GREEN and ensuring system solvency.

A portion of profits is held as Reserves, with the percentage set by governance, to increase GREEN backing and collateralization over time. The split between Stability Pool and Governance rewards is partly algorithmic, favoring the Stability Pool during protocol instability to support GREEN demand. RIPE holders cannot prioritize their own rewards at the expense of the protocol's health.

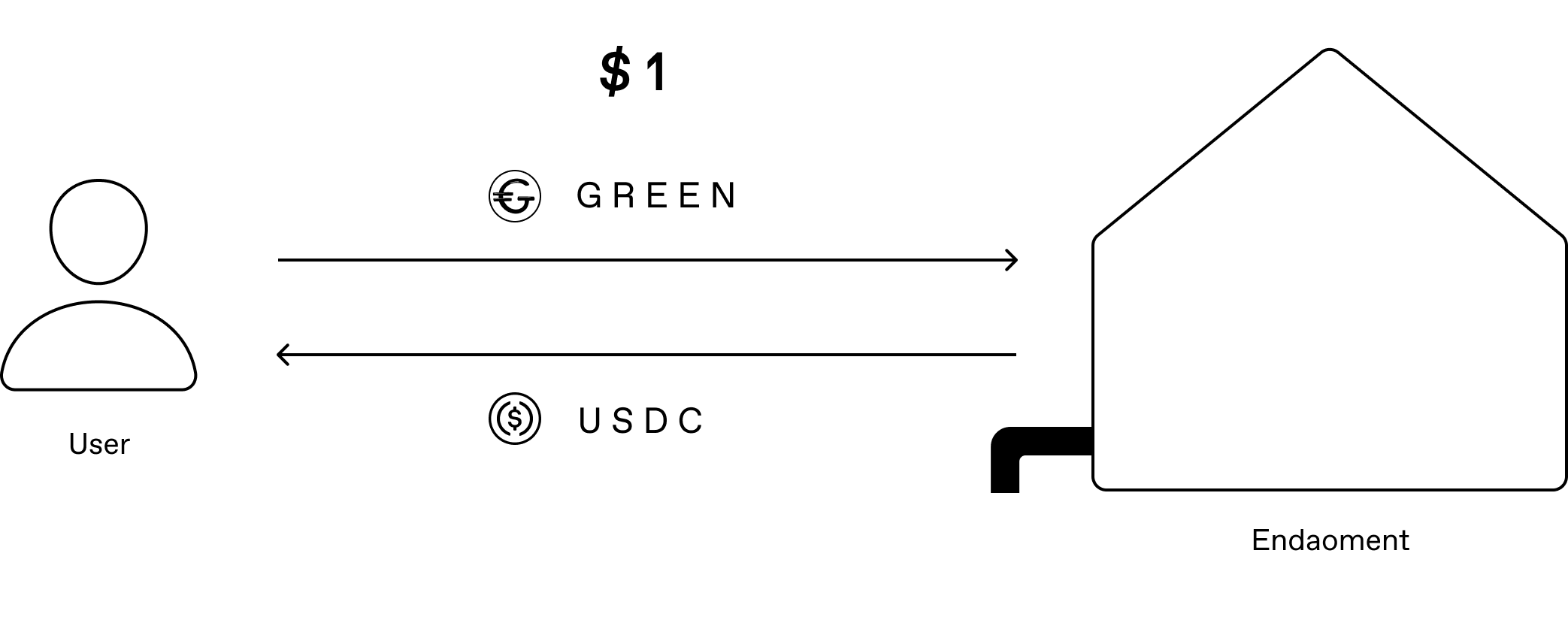

Emergency Redemption Mechanism for GREEN Stability

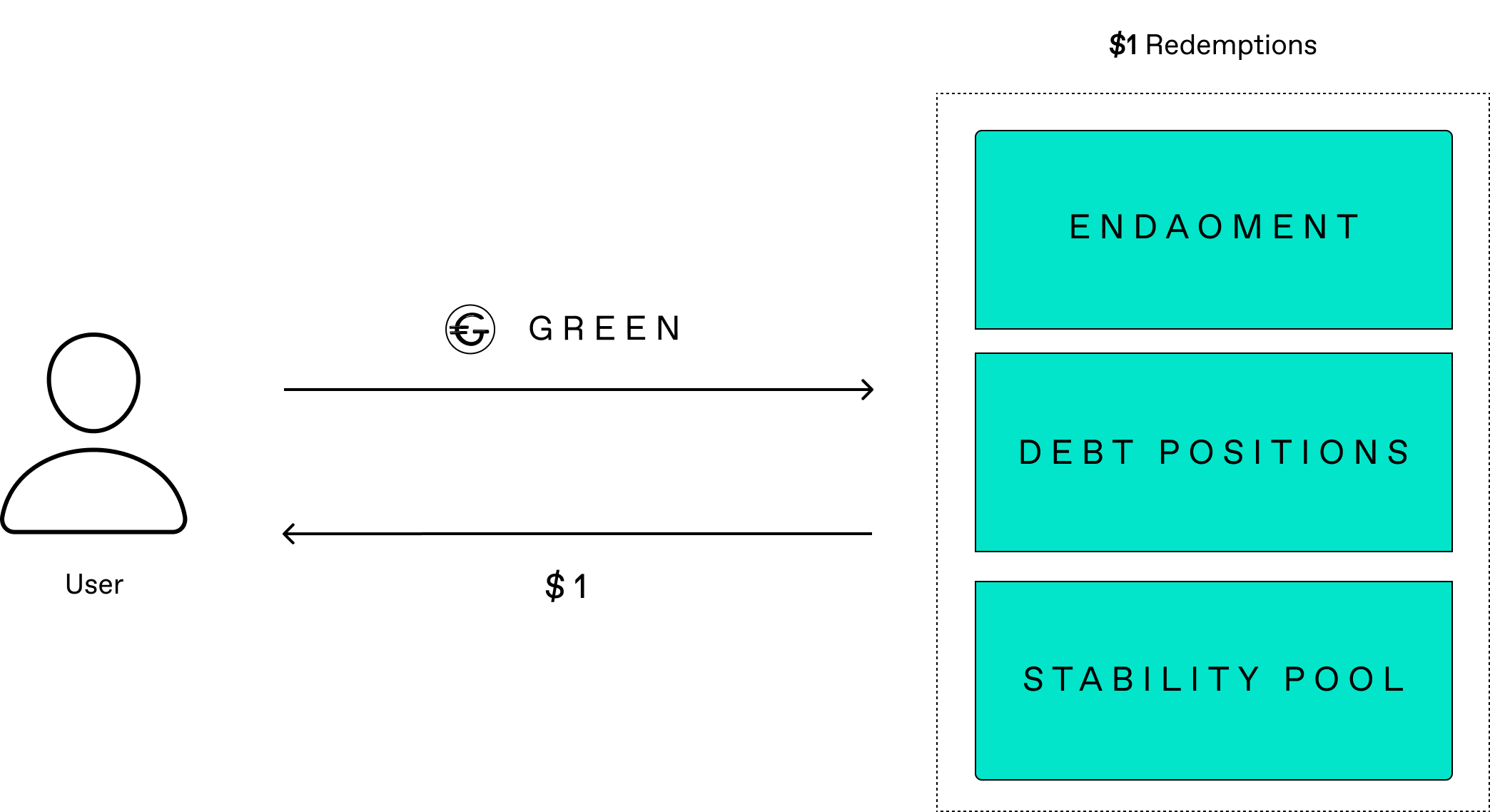

During severe peg pressure, governance can enable Endaoment redemptions, allowing users to swap GREEN for Endaoment positions at a fixed $1 value, regardless of GREEN's market price. This acts as a release valve during extreme volatility, helping GREEN maintain its stability as a dollar-pegged asset.

Users can also redeem GREEN through other mechanisms, such as unhealthy debt positions or Stability Pool claims.

GREEN Liquidity Management from the Endaoment

Building GREEN's liquidity is crucial for meeting borrower demand and building trust. The Endaoment grows its protocol-owned liquidity (POL) through methods like bonding to acquire GREEN LP tokens.

Additionally, the Stability Pool is a key source for the Endaoment to acquire GREEN LP. Rewards for depositing GREEN LP into the Stability Pool are significantly higher than for just GREEN. Several actions, such as liquidations, debt repayments, auction payments, and early withdrawal fees, can transfer GREEN LP from the Stability Pool to the Endaoment.

As the Endaoment accumulates GREEN LP, its Liquidity Wallet, managed by the Policy Committee, can help balance GREEN pools. If GREEN exceeds its peg, the Endaoment can mint and add GREEN to the pool. If it falls below, the Endaoment can withdraw GREEN or add USDC. These liquidity management tools ensure GREEN's peg stability.

Bonding Mechanism

One of Ripe protocol’s core promises is letting users "earn yield on anything." This is achieved through the Endaoment, which invests its funds and shares a portion of the yield with all depositors. The bonding mechanism plays a crucial role in raising funds to grow and sustain the Endaoment

Understanding Bonds: Traditional vs. Ripe Protocol

Bonds help governments and corporations raise capital by borrowing from investors, with a promise to repay the principal plus interest at maturity. They are low-risk and predictable, backed by credit. Similarly, Ripe protocol bonds operate the same way, but repayment is made in mintable assets.

Ripe protocol offers two types of bonds: RIPE and GREEN, which users can buy at a discount using assets like USDC. The protocol benefits by sending bond proceeds to the Endaoment, where they are deployed productively.

Bond Offering Mechanics

Governance can offer GREEN or RIPE bonds to the community at any time, specifying which assets (e.g., USDC) can be used for purchase. GREEN bonds are available for a set period (epoch), with increasing discounts over time. However, since supply is limited, waiting for a better discount risks missing out.

RIPE bonds follow a fundraising target, such as 100k USDC. The amount of RIPE per 1 USDC increases as the epoch progresses. Early buyers receive less RIPE, but waiting too long can result in missing out due to limited availability.

Bond payouts, whether in RIPE or GREEN, are not immediate; tokens are received at maturity. All bond terms, set by DAO governance, are clearly visible before bond purchase.

Maintaining GREEN’s Collateralization While Offering Bond Discounts

Even when sold at a discount for bonds, GREEN should always remain overcollateralized. When users borrow GREEN, their deposits are locked as collateral, with loans limited by a Loan-to-Value ratio (LTV), which is always below the total collateral value. The unused portion of the collateral continues to back GREEN, providing a cushion for discounted bonds.

Additionally, the Endaoment's assets—such as protocol revenue and RIPE bond proceeds—further strengthen GREEN's backing. Since RIPE bonds don’t create new GREEN, all proceeds enhance collateralization.

Users can lock deposits for a set period, whether borrowing or not, serving as “soft backing” for GREEN and earning a larger share of Endaoment yield and Ripe Rewards.

These factors provide extra backing for GREEN, enabling bond discounts. The Policy Committee tracks key metrics to recommend bond capacity and discounts, ensuring GREEN always remains overcollateralized.

Example: How Bonds Impact GREEN Collateralization

| Assets in Protocol | GREEN Liabilities | |

|---|---|---|

| User | $10k (NFT Deposit) | $5k (loan) |

| Endaoment | $2.95k (bond proceeds) | $3k (bond payout) |

| Total | $12.95k | $8k |

| Green Collateralization | 162% |

Total assets in Ripe now amount to $12.95k ($10k from the NFT, $2.95k from the bond sale), backing $8k in GREEN issued ($5k loan, $3k bond payout), resulting in 162% collateralization.

Now, assume the protocol raises $5k through RIPE bonds and earns $1k in revenue from prior activities.

| Assets in Protocol | GREEN Liabilities | |

|---|---|---|

| User | $10k (NFT Deposit) | $5k (loan) |

| Endaoment | ||

| GREEN Bonds | $2.95k | $3k (bond payout) |

| RIPE Bonds | $5k | |

| Revenue | $1k | |

| Total | $18.95k | $8k |

| Green Collateralization | 236% |

The Endaoment’s assets now total $8.95k ($2.95k from the GREEN bond, $5k from RIPE bonds, $1k from previous protocol revenue).

In this scenario, $8k of outstanding GREEN is backed by $18.95k in assets ($10k from the user's deposit + $8.95k from the Endaoment), resulting in 236% collateralization.

If the user repays their loan and withdraws the NFT, the protocol remains solvent, with $3k GREEN backed by $8.95k in Endaoment assets, maintaining 298% collateralization.

GREEN Stablecoin

GREEN is a synthetic US Dollar stablecoin, fully backed by collateral, similar to MakerDAO's DAI. Ripe users can deposit various assets into the protocol as collateral and borrow GREEN tokens, with the collateral locked until the loan and interest are repaid.

Scaling GREEN with On-Chain and Off-Chain Asset Support

The growth of most DeFi stablecoins is limited by how much users are willing to borrow, using crypto-only collateral. Ripe, however, supports a broader range of on-chain and off-chain assets, enabling it to scale to a mass market.

GREEN supply can also grow through locked deposits. Users can lock assets as "soft backing" for GREEN, boosting bond capacity, minting more GREEN, growing the Endaoment, and earning yield on their assets.

GREEN’s growth is limited only by the speed at which real-world assets are tokenized and brought on-chain. These assets include stocks, bonds, currencies, real estate, and personal items like houses, cars, and small businesses.

Sustaining GREEN Demand via Borrowing

User debt drives demand for GREEN, as borrowers must repay loans to unlock collateral, creating consistent buying pressure. If GREEN falls below its peg, borrowers are incentivized to buy and repay debt at a discount. During prolonged peg pressure, borrower interest rates will programmatically rise, further encouraging repayment.

During market volatility, borrowers are motivated to repay to avoid liquidation, helping counter sell pressure. A healthy debt level in the Ripe protocol ensures sustained demand for GREEN.

If borrowers can't repay, Ripe automatically liquidates their loans, with collateral claimed by Stability Pool depositors or auctioned at a discount. These mechanisms keep GREEN durable and overcollateralized, even during market shocks.

Growing Protocol-Owned GREEN Liquidity

Building GREEN liquidity is essential for protocol success. Greater liquidity encourages more borrowing and bonding, leading to a healthier Endaoment and a stronger growth flywheel.

The protocol seeks to acquire GREEN LP from various actions, including liquidations (Stability Pool), debt repayments, auction payments, and early withdrawal fees. While these actions can also use regular GREEN, the incentives are higher for GREEN LP.

Redemption Mechanisms for Maintaining GREEN’s Peg

Redemptions are crucial for maintaining GREEN's dollar peg. When GREEN falls below its peg, users or arbitrageurs can buy it at a discount and redeem it for $1 worth of assets, helping restore the peg. In the Ripe protocol, redemptions can occur in three ways:

Endaoment Redemptions: disabled by default to preserve assets, but governance can activate them during severe peg pressure.

Debt Position Redemptions: collateral assets can be redeemed when a borrower nears liquidation, with borrowers always having clear visibility of this threshold.

Stability Pool Claims: when assets are liquidated into the Stability Pool, users can redeem GREEN for those assets, allowing participants to auto-compound without managing claims.

Managing GREEN Supply: Minting and Burning Mechanisms

Since GREEN is a synthetic stablecoin, its supply fluctuates as it is minted or burned. The supply increases when users take out loans, buy GREEN bonds, or receive Endaoment yield distribution. Additionally, if GREEN trades above its peg, the Endaoment can mint more GREEN and add liquidity to the main pool.

The supply decreases when users repay loans, either directly or through Stability Pool liquidations. When users redeem GREEN for other assets (via the Endaoment, Debt Positions, or Stability Pool Claims), the redeemed GREEN is burned. If GREEN falls below its peg, the Endaoment can withdraw and burn GREEN to stabilize the pool.

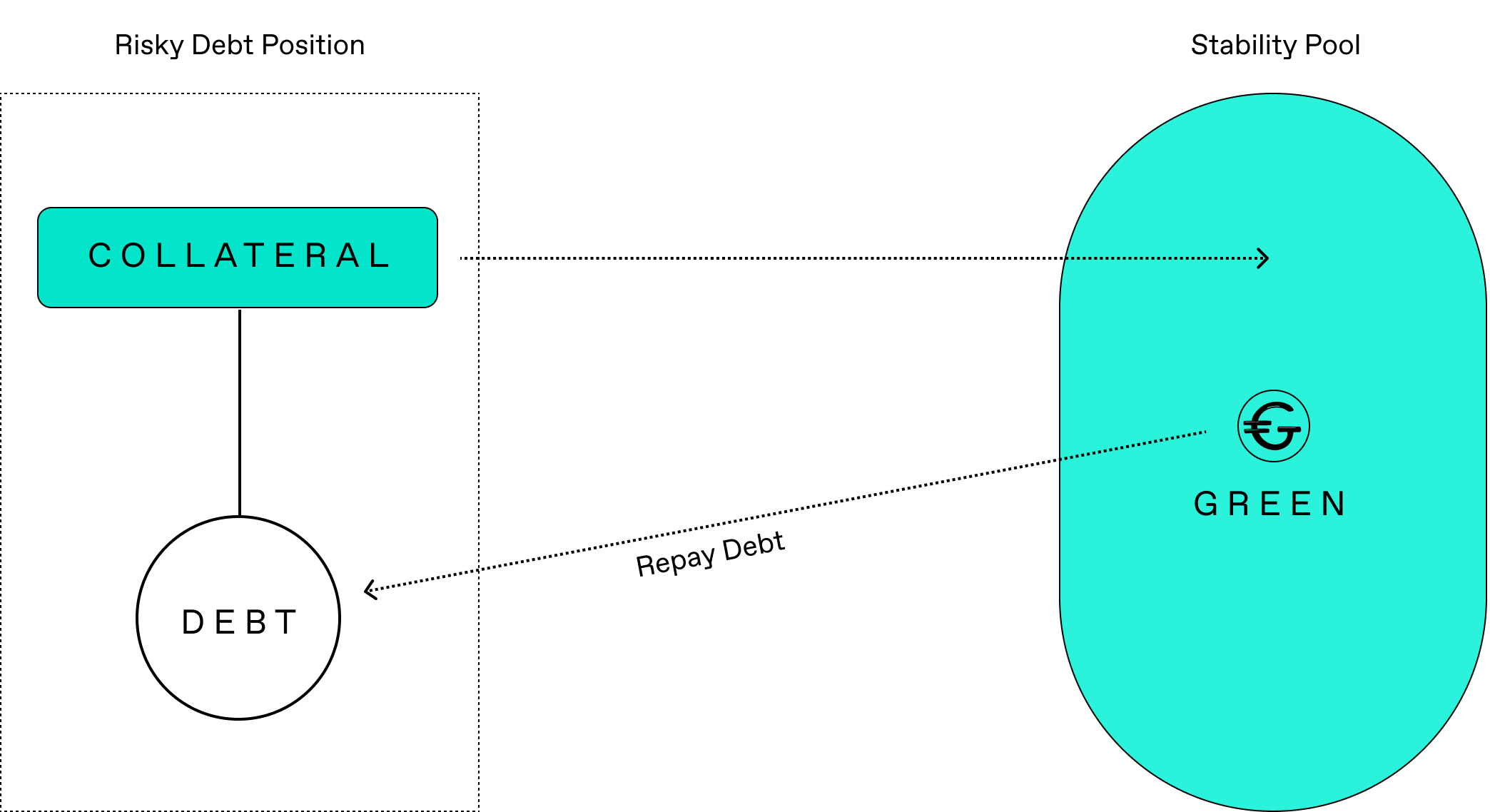

Stability Pool

Ripe Protocol offers a targeted deposit strategy for GREEN and GREEN LP tokens, known as the Stability Pool. This pool is crucial to the liquidation process, ensuring GREEN stays overcollateralized and the system remains solvent. The mechanism is inspired by Liquity’s Stability Pool.

Role of Stability Pool During Liquidations

Ripe Protocol allows users to deposit assets and borrow against them. If the collateral value approaches the debt amount, the user may be liquidated.

The Stability Pool instantly buys liquidated collateral, swapping GREEN or GREEN LP tokens for the user’s collateral until a healthy collateral-to-debt ratio is restored. If GREEN is used, it is burned as part of the debt repayment. If GREEN LP is used, it is transferred to the Endaoment as permanent protocol-owned liquidity.

The Stability Pool can only liquidate fungible tokens, excluding NFTs or assets with special permissions or allowlists. This ensures Stability Pool depositors receive only the most liquid assets.

Liquidation Fees and Incentives for Stability Pool Depositors

When a borrower is liquidated, they are charged a Liquidation Fee, which is paid to Stability Pool depositors. Although the pool holds less GREEN or GREEN LP after a liquidation, its overall value increases due to the fee paid out in the user’s liquidated collateral.

In addition to acquiring discounted collateral, Stability Pool depositors earn Endaoment yield and RIPE Rewards, both determined by governance. This creates a demand sink for GREEN and GREEN LP, even during periods of low volatility with fewer liquidations.

Claiming Liquidated Collateral in the Stability Pool

When assets are liquidated into the Stability Pool, depositors' share of the pool remains unchanged, though the total pool value increases.

Participants can claim liquidated collateral on a first-come, first-served basis. When they do, their share in the pool decreases, and the assets are transferred to their deposit accounts.

GREEN Redemptions and Auto-Compounding in the Stability Pool

Liquidated assets in the Stability Pool can be used for GREEN redemptions. If GREEN falls below its peg, users or arbitrageurs can buy GREEN on the open market and redeem it for $1 worth of claimable assets from the pool, helping restore the peg.

This process allows Stability Pool participants to auto-compound their GREEN or GREEN LP, removing the need for manual claims. During high volatility, it also replenishes the pool with more GREEN or GREEN LP, ready to absorb further liquidations.

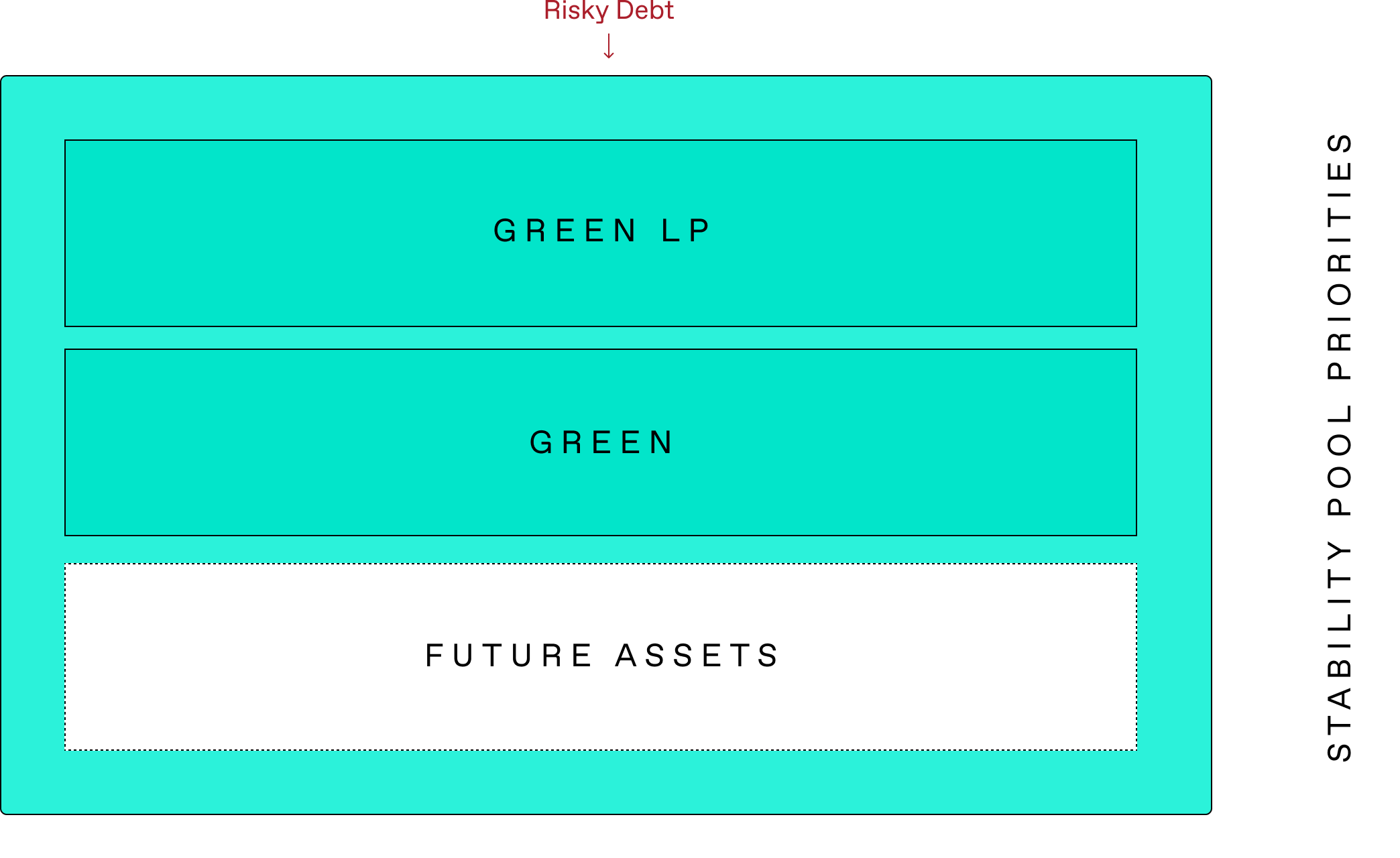

Stability Pool Asset Priority

Governance sets the order of asset use in the Stability Pool during liquidations, with GREEN LP used first to promote liquidity. At launch, the Stability Pool supports two assets: GREEN and GREEN LP (the main GREEN/USDC Curve pool).

When GREEN is used in a liquidation, GREEN depositors receive the discounted collateral, while GREEN LP balances remain unchanged. Each asset in the Stability Pool functions as an independent pool with its own claimable assets.

In the future, additional GREEN LP stablecoin pairs may be added, but volatile assets like BTC or ETH will not be supported.

Additional Utility for Stability Pool Depositors

The Stability Pool offers a simple and convenient home for GREEN or GREEN LP, with functions beyond its core role in liquidations. Users can repay their own debt, buy liquidated assets through fungible auctions, participate in NFT auctions, and pay early exit fees on locked deposits.

RIPE Staking & Governance

RIPE token holders govern the Ripe protocol through decentralized, onchain governance. As a true DAO, it's entirely controlled, owned, and managed by the community, with no admin keys or multi-sigs. Ripe’s governance system stands out as one of its most unique and defining features.

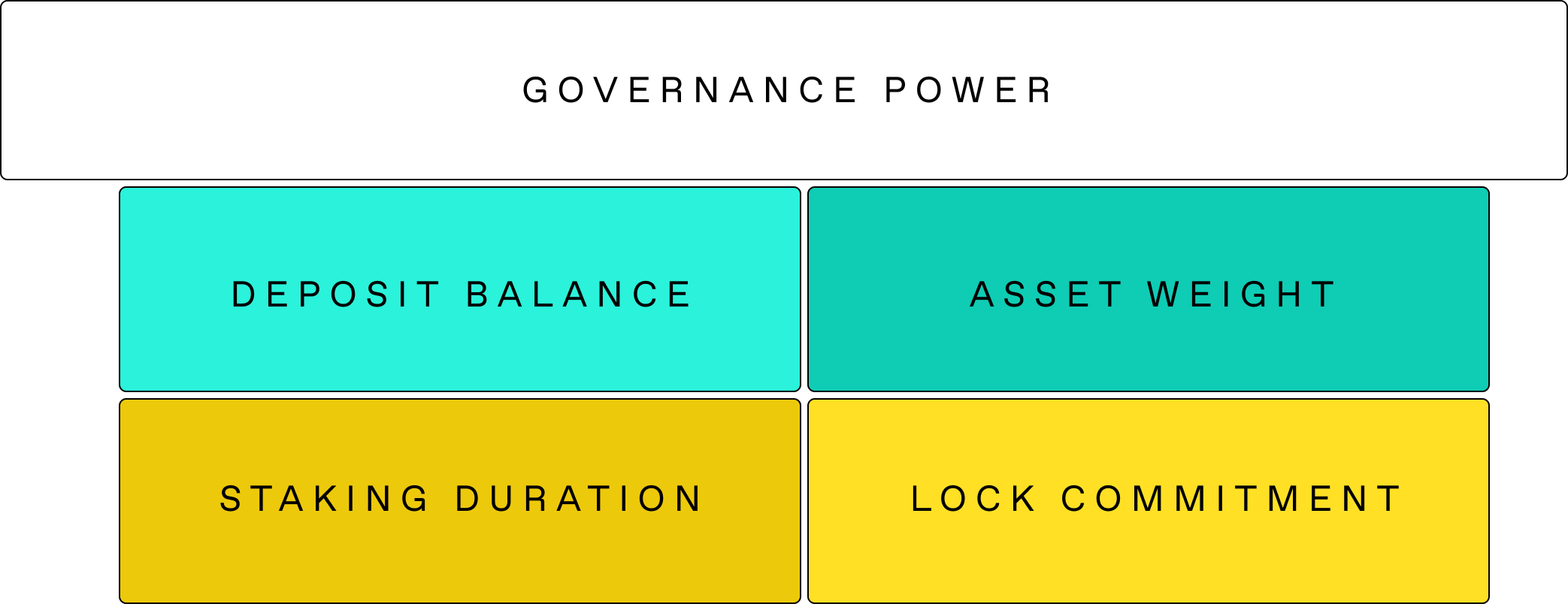

Factors Determining Governance Power

Users gain governance power in Ripe by staking RIPE or RIPE LP tokens. Governance power is based on:

Deposit Balance: amount of staked tokens.

Asset Weight: RIPE LP is weighted more than RIPE, as set by governance.

Staking Duration: time tokens have been staked historically.

Lock Commitment: time tokens are committed to be locked in future.

Governance power updates with each interaction and can be fully or partially delegated.

Minimizing Governance Attacks

Most governance systems focus on token balances at a single point, while ve/Curve-inspired systems consider future lock commitments. We believe historical actions and weighted LP assets are also important. These additional factors make it harder for malicious actors to quickly acquire RIPE tokens and attack the protocol via governance.

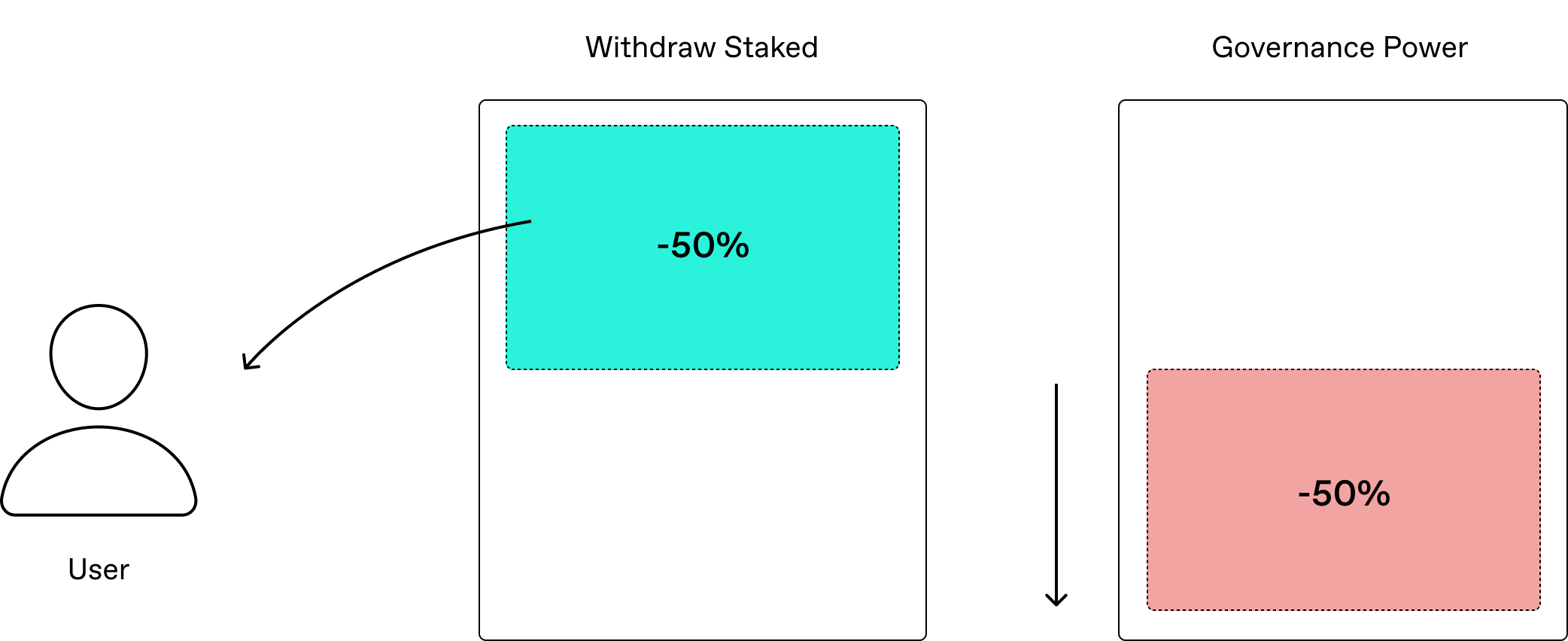

Impact of Withdrawals on Governance Power

When a user withdraws from staking, their governance power decreases proportionally. Withdrawing 50% of staked assets halves their power, and withdrawing all assets reduces it to zero. The system rewards long-term loyalty and commitment.

Challenges in Current DAO Governance

Many protocols engage in “governance theater,” where core teams cherry-pick proposals and hold token-holder votes that may be ignored by the multi-sig. This isn’t true decentralized governance.

On-chain governance is more transparent, with changes enforced by code, not the core team. However, most implementations are flawed—users must either participate in everything, which is time-consuming and lowers engagement, or delegate all governance power, leading to centralized control by insiders, the core team, or large token holders.

Inclusive and Flexible Governance for All

We’ve created a balanced governance system where token holders participate in key decisions, while elected expert committees govern specific protocol areas, with everything transparent on-chain. Here’s how RIPE token holders can engage in governance:

Dynamic Voting: a flexible, fluid system for key protocol decisions, allowing users to update votes anytime.

Committee Support: users can “soft delegate” to elected committee members overseeing specific areas.

Elections: token holders elect committee members during election cycles.

Constitutional Changes: major changes, like governance rules or RIPE supply, require a token holder vote.

The system suits all engagement levels. Passive users can make key decisions through Dynamic Voting, while active participants can track committee proposals and adjust their support (“soft delegation”) as needed.

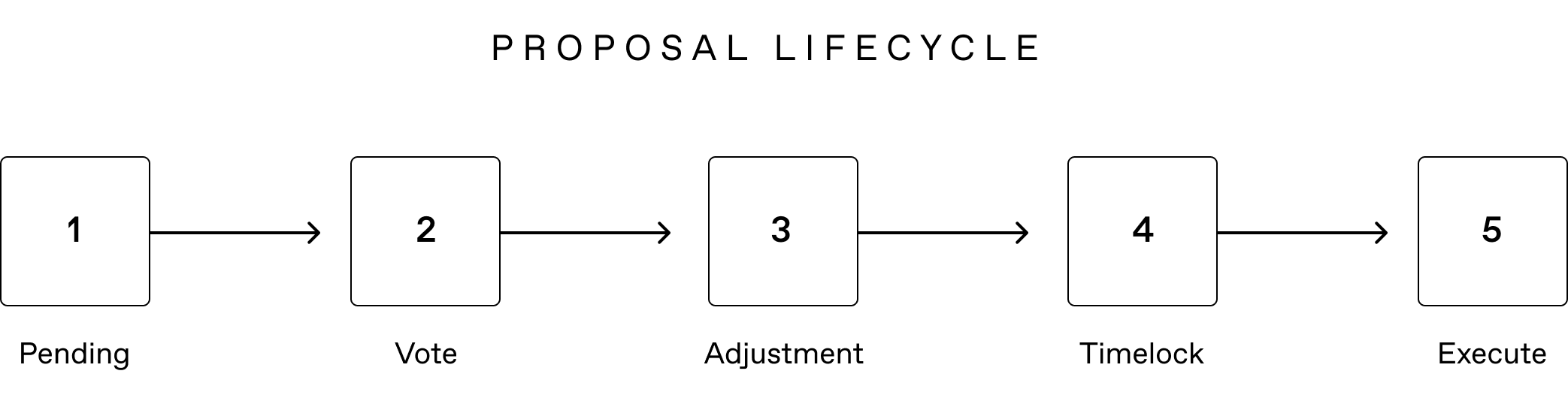

Structured Life Cycle of Protocol Changes

Beyond Dynamic Voting, all protocol changes follow a structured life cycle, either within a committee or for all token holders. Each proposal progresses through five stages:

Pending: waiting period before voting begins.

Voting: token holders or committee members vote.

Adjustment: token holders can adjust their "soft delegation" to influence committee proposals.

Timelock: waiting period before execution of approved proposals.

Execution: proposals are implemented.

Each proposal has specific requirements for quorum, passing, vetoing, etc., depending on participation and governance power.

Supervisory Committees and Flexible Governance Participation

The Ripe Protocol has hundreds of parameters, making it impractical for token holders to manage each one. Instead, Supervisory Committees guide proposals, with RIPE token holders electing representatives via on-chain elections.

Active participants can influence committee decisions during the Adjustment Period by adjusting their “soft delegation” to support committee members voting in their favor. Committee proposals must meet thresholds based on this delegation. Alternatively, users can “soft delegate” to trusted committee members without tracking every proposal, allowing for both active and passive participation.

At launch, the three Supervisory Committees are the Technical Committee (security and smart contracts), the Policy Committee (monetary policy, GREEN stability, and risk parameters), and the Oversight Committee (contributor compensation and a check on other committees). New committees can be added or modified through governance as needed.

Dynamic Voting: Continuous, Fluid Governance in Ripe

The Ripe protocol offers several dynamic governance areas where users can continuously adjust allocations, weights, or preferences. These key areas include:

1- Endaoment Investment Allocations

RIPE token holders decide how Endaoment assets are invested by setting and adjusting their preferred allocations across strategies. The Endaoment adapts based on the weighted preferences of participants.

2- Endaoment Yield Distribution

RIPE token holders determine how to distribute interest earned from the Endaoment across several categories: depositors, the Stability Pool (for users who deposit GREEN or GREEN LP), governance participants (those who stake RIPE or RIPE LP), DAO contributors (supervisory committee members), and impact (charitable causes).

3- RIPE Rewards (token emissions)

RIPE tokens are allocated for distribution to Ripe protocol participants, with token holders deciding how to allocate them. The recipients are similar to those for Endaoment Yield: depositors, the Stability Pool, governance participants, DAO contributors, and borrowers (replacing Impact).

The split between the Stability Pool and Governance is partially algorithmic, shifting rewards toward the Stability Pool during periods of instability to support GREEN demand. RIPE token holders cannot prioritize their own rewards over the protocol's health.

4- Deposit Rewards

RIPE token holders decide not only the percentage of Endaoment Yield or RIPE Rewards allocated to depositors (as a category) but also vote on which specific assets should receive rewards. This allows participants to direct rewards toward their preferred strategies and assets, fostering friendly competition for yield and driving demand for RIPE tokens.

Juice Score

Each Ripe user is assigned a Juice Score, ranging from 0 to 100, based on their contribution to the protocol. A higher score unlocks more benefits. The score is designed to be fair, offering both small and large depositors equal opportunities to earn a high score, calculated proportionally by dollar values and corresponding actions. The Juice Score aligns economic incentives with valuable behaviors, benefiting both the protocol and its users.

Economic Benefits of a Higher Juice Score

A higher Juice Score can have a significant economic impact, as the protocol rewards users based on their contributions. Key benefits of a higher Juice Score include:

Larger shares of Endaoment Yield and RIPE Rewards.

Better borrowing terms, including interest rates, loan-to-value ratios, and other debt terms.

Greater discounts on bonding and auction purchases.

Lower fees on GREEN redemptions from the Endaoment.

Reduced fees for exiting deposit locks.

Activities That Boost Juice Score

The Juice Score incentivizes actions that benefit the protocol. Key activities that boost a user's score include:

Borrowing: drives demand for GREEN, generates revenue, and grows Endaoment.

Governance/Staking: strengthens decentralization, making protocol more resilient.

Stability Pool: absorbs liquidations, reduces bad debt, and enhances GREEN liquidity.

Bonding: increases assets in the Endaoment.

Auction Purchases: pays down debt for liquidated users.

Collateral Redemptions: lowers liquidation risk by redeeming GREEN on risky debt.

Swap Assists: converts idle GREEN into USDC to increase Endaoment productivity.

Many actions have a decay factor, encouraging regular participation.

How the Juice Score Is Calculated

The Juice Score is calculated by summing the dollar value of a user’s positive actions (adjusted for decay) and dividing it by the total value of their deposits, excluding Governance and Stability Pool deposits.

For example, with $1,000 in normal deposits, $500 in debt, and $250 in bonds, the Juice Score would be 75 ($750 ÷ $1,000). In another case, if a user has $350 staked in Governance, $350 in the Stability Pool, and $350 in normal deposits, the calculation would be 200 ($700 ÷ $350), but since the maximum score is 100, it is capped at 100.

Juice Boost NFTs: Rewards for Testnet Participation

Ripe community members who participated in Sepolia testnet seasons received Juice Boost NFTs, which temporarily increase the holder's Juice Score when deposited in the protocol. Top performers received a larger boost, and each NFT has a fixed duration for the boost.